Winter weather and freezing temperatures are expected this week across Texas. The National Weather Service is forecasting widespread freezing temperatures on Friday and Saturday morning (12/23 – 12/24). In such conditions, it is imperative to protect the “Four P’s”: People, pets, pipes and plants.

People

- Keep warm, stay inside if possible.

- If you need to go out, dress in layers and wear hats, gloves and an appropriate coat.

- Avoid overexertion, as cold weather puts added strain on your body.

Pets

- Bring pets inside, and move other animals or livestock to sheltered areas.

- Keep adequate food and water available.

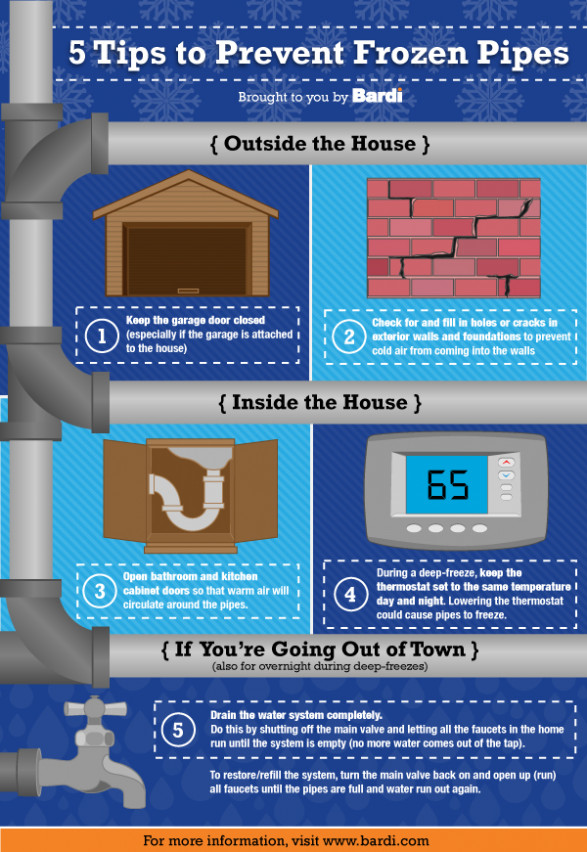

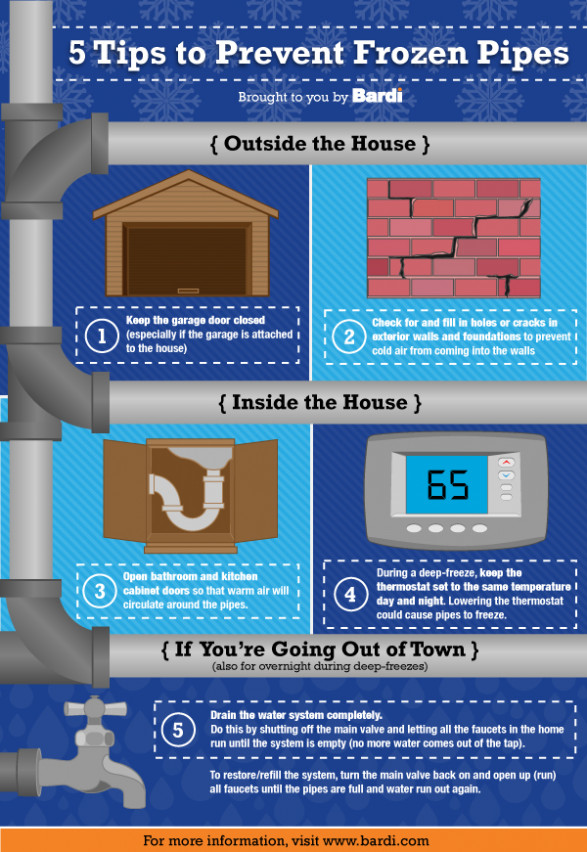

Pipes

- Disconnect outdoor hoses, drain and store in protected area.

- Wrap exposed faucets and pipes – including those outside the house or in unheated crawl spaces, attics, garages and other areas.

Plants

- Bring potted plants inside or store in garage near interior wall to provide extra warmth and protection from wind.

- For cold-sensitive outdoor plants, put down extra mulch and consider covering with a cloth fabric of some kind to shield the plants from wind and frost.

Additionally, if you have an irrigation system, turn off the water to the system at your backflow preventer and then drain the system so your irrigation pipes and sprinkler heads are not damaged.

As it pertains to the dripping of faucets, we are asking and advising our residents and customers NOT to drip their faucets. This could cause a dip in water pressure at your facility. If you reside within the greater Houston area and are part of the Regional Water Authorities (West Harris County Regional Water Authority, North Fort Bend Regional Water Authority, North Harris County Regional Water Authority), or receive water from the City of Houston, dripping faucets will put a strain on the system resulting in low pressure or even depleting the water system.

The following sites can also be used as a source of information and to keep you updated: